How To Know If Your CPA Really Understands Real Estate

Want my team to evaluate your tax situation for free?

Watch me review real tax returns and how we fixed them 👇

We've saved our clients $14M in taxes since 2021

Here are their stories:

Audrey // Travel Nurse + Short-Term Rental Investor

Income: $180k

Tax Savings: $33,120

Brian // Mortgage Loan Officer + Real Estate Investor

Income: $869k

Tax Savings: $102,860

Amy // Teacher + Short-Term Rental Investor

Amy had her returns filed by her local CPA, but they didn't understand real estate and repeatedly made mistakes.

She brought her returns to us and we found $24,000 of tax savings her past CPA didn't catch.

Want me to evaluate your tax return for free?

Ross & Jen // Short and Long-Term Rental Investors

Started working with us in 2021, owned 1x LTR and 1x STR.

Today, they own 5x properties, and pay less in taxes than when they had 2

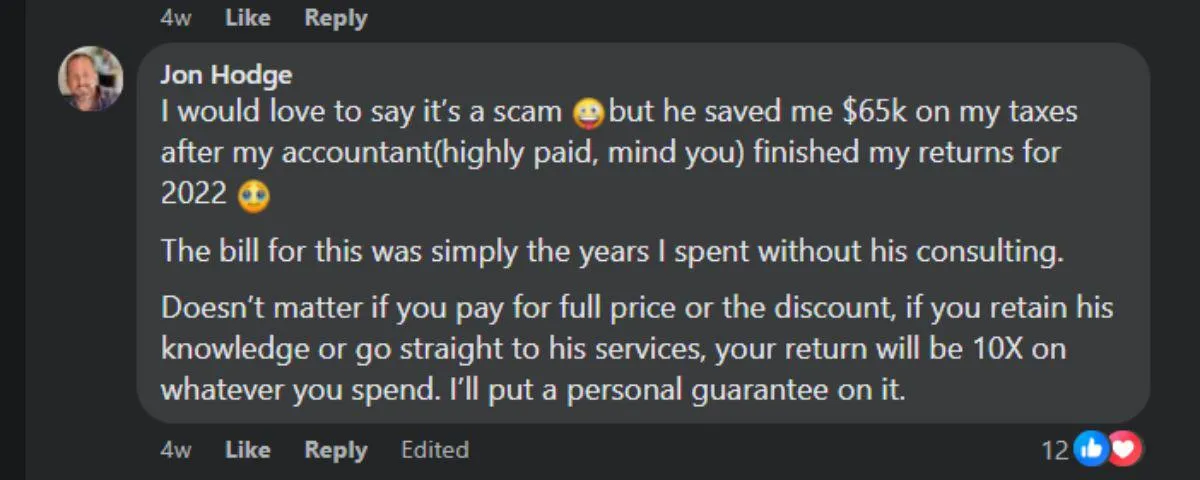

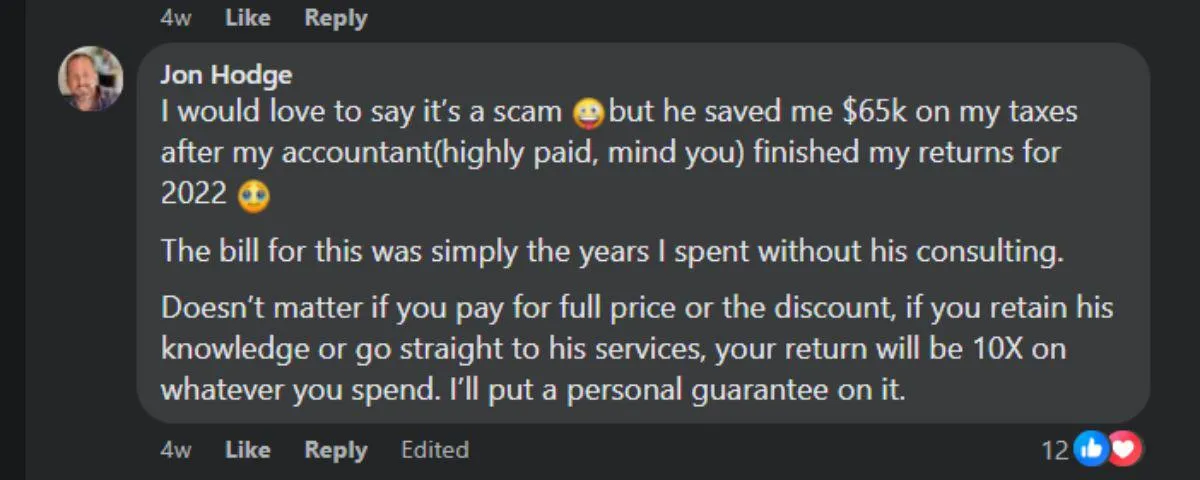

Jon // Business Owner + Real Estate Investor

Jon had his past accountant prepare his return for 2022, but the tax bill seemed higher than it should be...

He brought it to us for a review and we found $65,000 in missed savings!

Jenny // Short-Term Rental Investor

Was told by her past CPA that her STRs didn't qualify for tax benefits.

She came to us, and we found $90,000 of tax savings from prior years!

Trevor // Realtor + Real Estate Investor

Trevor was set to owe $60,000 in taxes when he came to work with us.

We helped him buy a short-term rental for $60,000 down, taking his tax bill down to $21,000. The US government essentially paid 2/3 of his down payment!

Want me to evaluate your tax return for free?

We've saved our clients $10M since 2021

Here are their stories:

Audrey // Travel Nurse

Income: $180k

Tax Savings: $33,120

Brian // Mortgage Loan Officer

Income: $869k

Tax Savings: $102,860

Amy // Teacher + Short-Term Rental Investor

Amy had her returns filed by her local CPA, but they didn't understand real estate and repeatedly made mistakes.

She brought her returns to us and we found $24,000 of tax savings her past CPA didn't catch.

Want me to evaluate your tax preparation plan for free?

Ross & Jen // Short and Long-Term Rental Investors

Started working with us in 2021, owned 1x LTR and 1x STR.

Today, they own 5x properties, and pay less in taxes than when they had 2

Jon // Business Owner + Real Estate Investor

Jon had his past accountant prepare his return for 2022, but the tax bill seemed higher than it should be...

He brought it to us for a review and we found $65,000 in missed savings!

Jenny // Short-Term Rental Investor

Was told by her past CPA that her STRs didn't qualify for tax benefits.

She came to us, and we found $90,000 of tax savings from prior years!

Trevor // Realtor + Real Estate Investor

Trevor was set to owe $60,000 in taxes when he came to work with us.

We helped him buy a short-term rental for $60,000 down, taking his tax bill down to $21,000. The US government essentially paid 2/3 of his down payment!

Want me to evaluate your tax preparation plan for free?

© 2025 Tax Strategy 365

TERMS & CONDITIONS | PRIVACY POLICY

This site is not a part of the YouTube, Bing, Google or Facebook website; Google Inc, Microsoft INC or Meta Inc. Additionally, This site is NOT endorsed by YouTube, Google, Bing or Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc. YOUTUBE is a trademark of GOOGLE Inc. BING is a trademark of MICROSOFT Inc.